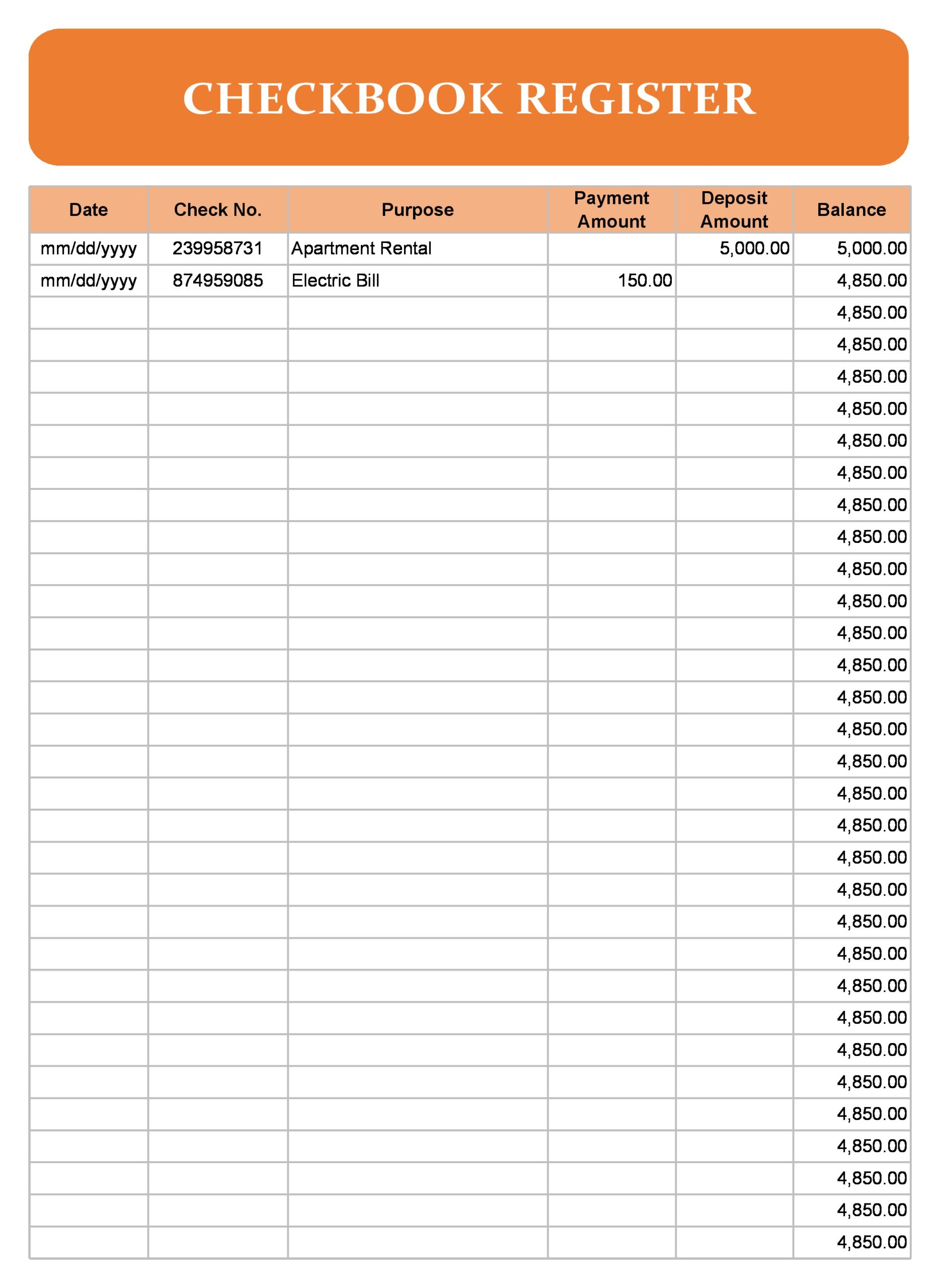

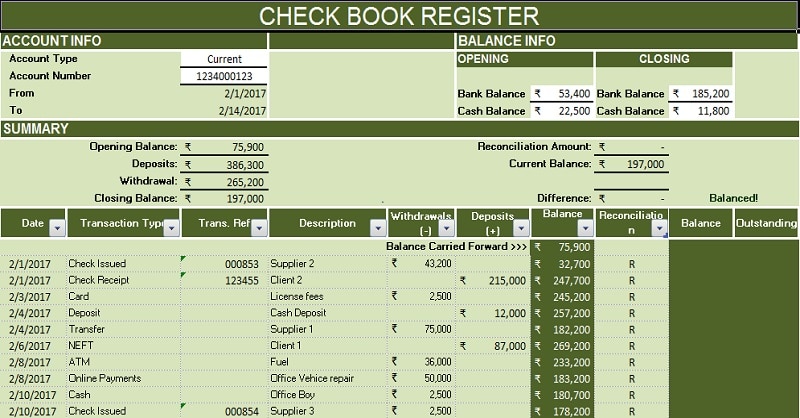

How to Balance A Checkbook & Reconcile A Bank Statement Using WalletHub's Check Register Template 1. Save this file on your desktop or print a copy. Enter your starting balance in the pre-labeled row under the 'BALANCE' column. In the “CHECK NUMBER/CODE” column, enter the check number or select a code from the table below. Creating a checkbook register from scratch is a challenging task. If you want to make this job easier, you can download our free checkbook register templates in either Microsoft Excel or Word and personalize them according to your business. Go through our checkbook register templates and choose one that serves your needs. Jan 09, 2020 A simple check book register is very useful for keeping track of your account balances for your home business or personal finances. If you'd like a budget-friendly solution, try our free check register template below. It can also be used as an account register for savings accounts and credit card accounts. You can track multiple accounts. Creating a checkbook register from scratch is a challenging task. If you want to make this job easier, you can download our free checkbook register templates in either Microsoft Excel or Word and personalize them according to your business. Go through our checkbook register templates and choose one that serves your needs.

Printable Check Register

What is the purpose of the check register?

Definition: A check ledger, also known as a cash disbursement book, is the document used to record all checks, cash transfers, and cash outlays over a period of accounting. Will I need to keep a check register? A: The short response is yes, you certainly need to update your test list. Here's the explanation. So long as you use checks, you do not know the true balance in your account until you enter the unchecked checks that you wrote against that account. The use of a log allows you to capture errors.

Why is it important to balance your checking register?

It's much easier to evaluate your revenue and expenditures, particularly at tax time. It will back up your savings goals. Routinely monitoring your checking account balance could help you save money on banking fees and prevent fraudulent transactions from wrecking your account.

What does a check register include?

A check register is a ledger in which all check payment dates, check numbers, payment amounts, and payeee names are recorded. ... Also, the report can be used as part of the bank reconciliation process, to decide which checks released have not yet cleared the bank, and thus reconcile objects.

How long should you keep a check register?

Some people recommend keeping checkbook records in case 'issues' (payment questions) occur for at least 12 months and because some checks may take a while to clear.

Are checkbooks obsolete?

Despite their steady decline in use, however, checks have not become extinct altogether. We are still keeping our money in checking accounts, we are still juggling our checkbooks, and new banking innovations are being implemented (for example, mobile check imaging) to boost the process of paying by check.

Managing your personal or business bank account is a never-ending process. The process only gets more challenging, if there is more than one person making these transactions. If you are unable to keep track of your checking account activity, there will definitely be risks of overdrawing. Many financial institutions will charge overdraft fees, which can range anywhere from $20-40 on each overdraw.

Eliminate Potential Errors

If you are serious about enhancing your accounting skills, you should take advantage of the printable check register. This model document contains the most important details of your checking account activity. There are categories for cash withdrawals, direct and cash deposits, automatic bill payments, and debit card purchases. The format is very simple, so anyone can utilize the spreadsheet without difficulty.

Getting Everyone Involved

The great benefit of utilizing readymade documents is you can print them out or store them on your computer. If you share your checking account with others, you should supply them with a check register, so they can jot down their transactions as they make them. You can also alter the color and font size to suit your needs and preferences, before printing. The paper check register is the most efficient way to monitor your checking account balance.

Free Check Printing Template Pages Ledger Sheet

Preview